This Web page employs cookies to enhance your navigation encounter. Necessary cookies are automatically saved on your own browser, as they are essential for the web site's simple features.

Increased Effectiveness: By leveraging technological know-how and progressive answers, firms can streamline their KYC processes, minimizing wait periods and enhancing performance.

This has led to your implementation of stricter Know Your Purchaser laws by governments and monetary authorities around the world, making certain that companies get the necessary actions to protect them selves as well as their customers.

AML risk assessment is an important approach for companies during the fight in opposition to money laundering and terrorist financing.

Key Risk Indicators (KRIs) are vital resources from the AML risk evaluation process. They are specific metrics or facts factors that help determine and evaluate likely risks affiliated with money laundering and terrorist financing.

The change in notion encompassing blockchain marks a pivotal second within the evolution of global finance. When regarded with suspicion, blockchain is now staying reframed for a Main part of digital infrastructure.

Fourth, the maturity of the business’s controls and talent of the business to test and update its compliance program.

Compliance with Rules: By utilizing a strong KYC system, businesses can make sure compliance with KYC laws and steer clear of potential penalties and reputational harm.

By verifying the identification of customers and assessing their risk, enterprises can much better detect suspicious pursuits and consider suitable action.

Receiving "soiled" cash from the high-risk counterparty can result in major issues, such as blocking of resources and lawful penalties. First of all, you must suspend even further transactions. Later on, it's important to Get in touch with legislation enforcement agencies and exchanges for cooperation.

The most crucial goal of KYC should be to confirm client identities and stop money laundering and fiscal fraud. The four Key aims of KYC are:

Electronic Id Verification: While using the rise of electronic technological innovation, businesses can now confirm the identification aml bot official in their clients remotely and in authentic-time utilizing Innovative applications like facial recognition, biometrics, and electronic document verification.

Hundreds of thousands of usa citizens are victimized by fraudsters daily, some shedding their hard-attained everyday living financial savings. These schemes damage the public and weaken the integrity of our markets.

Users have the option to select from 3 distinctive modes of operation, Just about every catering to different priorities and desires:

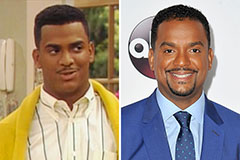

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!